4 Jul 2012

Some Transition reflections on George Monbiot’s announcement that “we were wrong on peak oil”

George Monbiot announced in the Guardian on Monday “We were wrong on peak oil. There’s enough to fry us all“, an article which concluded “peak oil hasn’t happened, and it’s unlikely to happen for a very long time”. Several people have written, and even stopped me while I’ve been out shopping, to ask for my take on his piece, so here it is. It has been a tricky thing to write, as in the time it took me to compose it, so many other interesting analyses of it have been posted, many of which I have tried to reference here. In a nutshell, I think Monbiot’s piece swallows an over-optimistic take on peak oil, and there are things in his piece that I disagree with and things that I agree with, although I don’t for a moment consider myself a peak oil expert. What he does prompt is a rethink in terms of how we present peak oil. Let’s start with the things I disagree with.

George Monbiot announced in the Guardian on Monday “We were wrong on peak oil. There’s enough to fry us all“, an article which concluded “peak oil hasn’t happened, and it’s unlikely to happen for a very long time”. Several people have written, and even stopped me while I’ve been out shopping, to ask for my take on his piece, so here it is. It has been a tricky thing to write, as in the time it took me to compose it, so many other interesting analyses of it have been posted, many of which I have tried to reference here. In a nutshell, I think Monbiot’s piece swallows an over-optimistic take on peak oil, and there are things in his piece that I disagree with and things that I agree with, although I don’t for a moment consider myself a peak oil expert. What he does prompt is a rethink in terms of how we present peak oil. Let’s start with the things I disagree with.

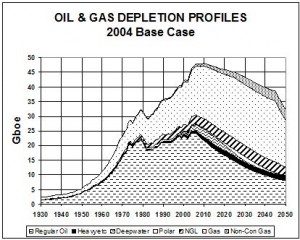

Firstly I would question the idea that it is somehow news to anyone that there are a huge amount of as-yet-unexploited hydrocarbons in the world. I first became interested in peak oil in 2004 when I met Dr. Colin Campbell and heard him speak. Here (right) is one of the graphs from that talk. While the shape of the peak itself has actually turned out to be more of a plateau than a peak as shown here, what I want to note here is the size of the second half of the Age of Oil, the downward half. It’s huge, so huge it doesn’t fit on Campbell’s graph.

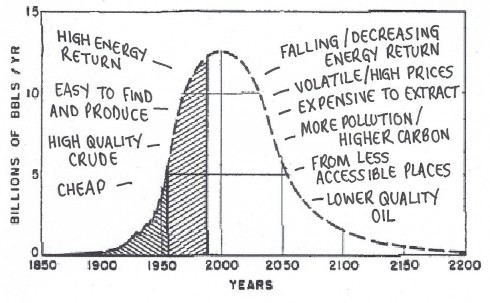

As I noted in The Transition Companion, like a game of football, the oil age has been ‘a game of two halves’ (see image below).

The first half featured mostly easy to find, easy to refine oil. The second half is what Michael Klare calls ‘The Age of Extreme Energy’, the tar sands, fracking and so on. Monbiot writes as though the idea that “there’s enough oil to fry us all” is some kind of a revelation to the peak oil world, that everyone had blindly assumed that peak oil meant climate change was cancelled. Not sure if I missed something and am unique among peakists, but I had always understood that not to be the case. Luckily at least Sharon Astyk shares that take on things, writing “no one with four brain cells to rub together has ever thought that peak oil could get us out of climate change – since the emergent consensus that 350ppm might represent a critical tipping point, there’s very little debate on this subject by credible scholars, simply because we know we could cross that line because we have”.

Monbiot refers to “monstrous deposits in the United States: one estimate suggests that the Bakken shales in North Dakota contain almost as much oil as Saudi Arabia”. Yet these deposits have been known about for a long time, and, unless I am very much mistaken, are included in Campbell’s graph. The difference is that now the technologies to extract them seem to have come about sooner than anticipated. It is mportant not to get too carried away though, as the folks at Automatic Earth argue in their post ‘Unconventional oil is NOT a game changer’. There may be as much oil in Bakken as there is in Saudi Arabia, but getting it out is another challenge altogether. Extracting the oil from the Saudi oil fields was a breeze, like drinking hot chocolate through a straw (not advisable though, Health and Safety, how about chocolate milk?) as compared Bakken, which is more like to trying to extract the same amount of chocolate from a chocolate brownie. It’s an entirely different process. Plus, as Bill McKibben is wont to say, when we began extracting the oil from Saudi Arabia we didn’t know about climate change. That’s not a luxury we have as we size up the oil shale and the tar sands.

Monbiot’s article, as I read it, is referring to the ability to extract oil from reserves, not any meaningful increase in actual reserves. He also ignores whole area of Energy Return on Investment of these unconventional oils (according to Richard Heinberg, tar sands have an EROEI of 5.2:1 – 5.8:1 and oil shale of 1.5:1 to 4:1, and Automatic Earth have some interesting things to say about EROEI), which are a key argument against the idea that oil extracted in this way is comparable to oil from the first half of the oil age, which we may look back on as being a clean, green fuel by comparison.

Then there’s the foundation on which the article is based. It is disappointing that Monbiot, who has previously written so incisively about peak oil (for example here, here and here) has so resolutely and publicly decided that the whole idea is a nonsense, especially when you look at the basis for this volte face. It appears to be based entirely on a new report from Harvard University, entitled ‘Oil: The Next Revolution: the unprecedented upsurge of oil production capacity and what it means for the world’. The report was authored by oil executive Leonardo Maugeri, although the possibility that he may be inclined towards a somewhat optimistic take seems to have been lost on Monbiot.

This report has also been the subject of an analysis by Heading Out at the Oil Drum who has questioned many of the report’s basic assumptions, concluding “enough, already! There are too many unrealistic assumptions to make this worth spending more time on”. Sharon Astyk summarises some of Cohen’s key concerns as “including capacity for production that Saudi Arabia has claimed but never demonstrated, a huge leap in Iraqi oil production, which everyone has said will happen any day now since 2003 and hasn’t, and a lot of overstatements of US shale production”.

Then there’s the idea that somehow the peak oil has been disastrously off-target in terms of its forecasting, that the whole activity has been a complete waste of time. Monbiot states that “some of us made vague predictions, others were more specific. In all cases we were wrong”. Well kinda. As Richard Heinberg pointed out recently, although predictions are always a very inexact science, it is actually the ‘peakists’ who have been more accurate in their predictions than the likes of cornucopians such as Daniel Yergin.

A recent study from the IMF, ‘The Future of Oil: geology versus technology’, which set out to see what has driven the changes in oil prices over the past 10 years, concluded that most of those price fluctuations can be explained by depletion above all other explanations. Clearly predicting the future of oil availability and price is always going to be a hit-and-miss exercise, but in spite of Monbiot’s listing of failed predictions, my sense is that the peak oil movement has been proven right in some ways. For example, as the International Energy Agency noted recently, conventional oil did peak, in 2006, and has been in sharp decline ever since, hence the need for the unconventional oils, which unless you had to, you would never even bother with, given the challenge and cost of their extraction, unless you had no other options, unless the age of cheap energy weren’t well and truly over. The outstanding question is whether unconventional oils can fill the gap left by the depletion of conventional oil, and for me, in spite of everything in Monbiot’s article, is still the key question left unresolved.

Overall, I thought that Dave Cohen captured it well a while ago in a post on OilPrice.com:

“There are basically two camps about the peak of global oil production.

• Cornucopians — Not only is the glass half-full, it is brimming over. There is no threat whatsoever to industrial civilizations. The Stone Age didn’t end because we ran out of stones.

• Doomers — The glass is half-empty and we’re draining it fast. Industrial civilizations are going to collapse soon because there won’t be enough oil to go around. A new Stone Age is right around the corner.Both these “schools of thought” are wildly incorrect. These are emotionally-based positions which have little to do with Reality. Naturally there are many more Cornucopians than there are Doomers because mindless optimism is the default human position (mistake) in all matters, not just oil. I can demolish both positions in two sentences.

• Cornucopians do not know how to subtract.

• Doomers do not know how to add.

Of course when I say these people don’t know how to add or subtract, I am describing the psychological requirements of these groups. Cornucopians cannot acknowledge that oil fields peak and decline, and that global oil production might do the same. Doomers cannot acknowledge that technology, exploration and wars in Iraq bring new resources on-stream. By and large, members of both groups know bugger all about the global oil industry”.

So now I’ll move on to where I agree with Monbiot, or at least where his post can trigger a useful conversation. It does feel that the argument around peak oil has changed since Transition kicked off in 2005. In 2005 it seemed that we were on the cusp of a supply crunch, that supply and demand were about to part company with each other, that $200 a barrel oil was a matter of just a few years away and that sudden and rapid change was inevitable. I think perhaps that we underestimated the resilience, the ‘bouncebackability’ if you like, of the industrial growth system, at least in terms of its ability to evolve new extraction technologies. In terms of managing its financial affairs it’s a different story.

As Monbiot puts it, “the automatic correction – resource depletion destroying the machine that was driving it – that many environmentalists foresaw is not going to happen”. Fair enough, but his article fails to mention the dire economic situation much of Europe is now facing, which has dampened demand and has replaced peak oil (temporarily) as our key limitation to growth. That is a challenge that is set only to worsen, in my opinion.

The International Energy Agency has frequently warned that any economic growth in the EU would lead to an increase in demand for oil which would derail that growth. David Strahan, in Petroleum Review, quotes Michael Kumhof, one of the authors of the IMF report, as saying “we have to do these really expensive and environmentally messy things just in order to stand still or grow a little bit … it doesn’t mean the picture is all rosy”. The reality is that rather than our not having access to oil, for many people the economy is becoming so screwed that they can’t afford it anyway.

A friend visited from Ireland last weekend. She told me of a neighbour who 4 years ago built a big house, as big as his mortgage would allow in the days of almost unbridled cheap credit, and fitted oil fired central heating. He then lost his job, and while his wife still works, he is now a beekeeper and is helping my friend with her bees. He went round the other day, in June, and over tea said “this is the first time I’ve been warm all day”. They live in what 4 years ago was a desirable residence, which is now entirely inappropriate. Huge. Cold. During the winter they basically live in one room with an open fire. That is only partly the result of high oil prices, however caused. Mostly it is a result of the debt crisis, a crisis that has only just begun. Makes no difference to him though. He’s still cold whatever. There is nothing in Monbiot’s article that will heat his house next winter.

The important question for me is where are we now? Where do we go from here? The idea that our only option if we want to avoid a rapid collapse is an orgy of extracting unconventional oils by any means necessary is a logical idea when viewed from the perspective of the industrial growth system. This is the same myopic mania that has redefined sustainable development as ‘sustainable growth’ and is hell-bent on a return to growth at all costs. It is rather like an abusive husband who cannot see any option for his partner other than himself, while pschologically denying to himself the damage he’s doing.

However, viewed from a more holistic perspective it makes no sense at all. The “we were wrong about peak oil” argument only really works as something to get excited about if you are a cornucopian who also believes that free market economics and deregulation is the key to economic growth and prosperity. It also helps if you believe that climate change is a scam, which fortunately many of those who argue that “green is the new religion” and that we live in a world of bountiful resources do, the likes of Nigel Lawson and ‘rational optimist’ Matt Ridley.

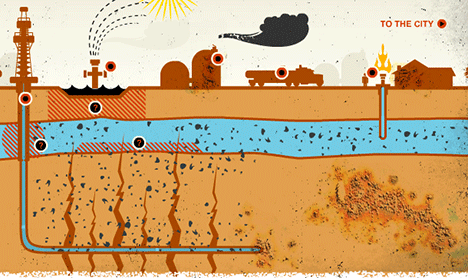

Embracing the hydrocarbons that will define the second half of the oil age will, as Monbiot puts it, “fry us all”. Climate change is hardly the only impact though. Kurt Cobb wrote recently about how the rush to unconventional oils would reduce the US to what he called “Pincushion America”, citing a former EDA engineer’s prediction that within 100 years most of the country’s underground drinking water reserves will be contaminated. In other words, one consequence of our moving into the “second half” of the age of fossil fuel extraction is that, in our desperation, we create even more difficult challenges for us and for our descendants.

Extracting unconventional oils also takes a huge amount of water. They drive indigenous peoples from their ancestral homelands. They concentrate money and power into the hands of oil companies and their wealthy investors. They cause earthquakes (the UK government’s position on fracking seems to be “if it causes an earthquake, just stop for a day and then start again”). Our oil dependency will remain a key vulnerability for our economies. As David Strahan puts it, “these days both consumers and producers have been praying for lower prices to keep the wheels from falling off the global economy”. We can surely do better than that.

The depressing part of Monbiot’s article is the sense that now that power is once again consolidating into the hands of oil executives, we are never going to kick the fossil fuel habit in time. It reads as though he has thrown in the towel. So where is this change going to come from?` I know you will be expecting me to suggest that perhaps the Transition movement might be the answer, and you’d be right, but with a caveat. As Rio+20 recently made clear, and as Transition has stated from the outset, “if we wait for governments it will be too late”. I believe more than ever that the drive for change will need to come from communities, from citizens, from ordinary people coming together and getting on with it. I am thinking about calling the next book I do “The Thrill of Just Doing Stuff” because I think that is ultimately what it’s about.

Fracking, shale oils, heavy oils, are the path to a world where power, resources and control continue to be taken out of the hands of ordinary people and into the hands of those that would ruin the world. Transition offers a different story, one that is about living more within our means, connecting to place, returning power to people and communities, building resilience at the local level. For me it has much more claim to the term “rational optimist” than Matt Ridley’s world of climate denial, growth-fetish economics and centralisation of power. My caveat though is that it is still far far too small.

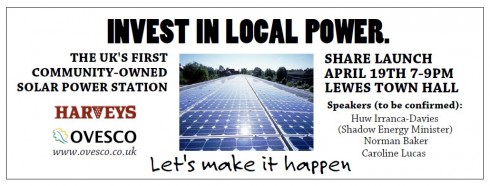

Whether it is called Transition or not is irrelevant, given that we are seeing an amazing flowering of community energy initiatives, local food initiatives, pioneering local authorities, new investment mechanisms designed to kickstart sustainability initiatives and a lot more. I do think however that the approach that Transition initiatives have collectively evolved and refined is one of the most powerful tools we have at this time. It is self-organised, self-replicating, driven, motivated and positive. It is creating new organisations, new models for inward investment, a new momentum towards rethinking local economies. It waits for permission from nobody. It is starting to model the alternative to the unconventional fossil fuel hell that will otherwise be unleashed upon us.

It is still far too small, but it can scale up. It needs investment (we’re working on it), it needs to actively support the emergence of new, more resilient, more localised economies (it’s here) it need more people (like you?), it needs exposure (perhaps Monbiot could be doing that rather than writing articles like this?) and that’s about it. Most of the other obstacles are of our own imagining. The kind of world Monbiot warns us of here may well be our only option (although we can draw a lot of inspiration from the countries that are actually getting on with installing renewables rather than just talking about it, such as Denmark and Germany), but while we need the holding actions, the campaigns to hold it back, we also need the rapid proliferation of a bottom up approach, and Transition is the best attempt I’ve seen so far (but then I would say that wouldn’t I?!). It is ultimately only by withdrawing our support, our investment, our purchasing power, from the industries that see no choice other than squeezing every miserable drop out of the last days of the oil age that we will get anywhere. And we can only do that if we have a compelling story about what we could create instead.

Monbiot himself wrote in 2005 “Our hopes of a soft landing rest on just two propositions: that the oil producers’ figures are correct, and that governments act before they have to. I hope that reassures you”. I see absolutely no reason based on anything in his most recent article that anything whatsoever has changed in relation to those two propositions. It is clear that whether it is because of the debt crisis, climate change or peak oil, a smooth landing looks increasingly unlikely. I for one have no plans to toss the peak oil analysis into the rubbish just yet. Rather we refocus and move on with the important work that remains to be done.

Nicole Foss

17 Jul 8:13am

Peak Oil: A Dialogue With George Monbiot

http://theautomaticearth.com/Energy/peak-oil-a-dialogue-with-george-monbiot.html

Unconventional Oil is NOT a Game Changer

http://theautomaticearth.com/Energy/unconventional-oil-is-not-a-game-changer.html

There’ll be another article on this topic up soon at TAE in response to Jeff Rubin’s assertion that peak oil caused the financial crisis. Life is far more complicated that Mr Rubin seems to think.

Chris D' Cruz

18 Jul 4:17pm

Guys! You are not doing the sums properly. Our financial sysmem requires growth in the economy. This enables interest to be paid on loans. Without sustained growth there must be economic misery (with the ludicrous system that is in use). Simple interest loans require compound growth in consumption. i.e exponential growth. 7% interest necessitates doubling the size of the economy in ten years. So unless we all work twice as hard we need to DOUBLE our use of energy every ten years to achieve this level of growth every ten years this would just enable us to service all the loans paid back at 7% obviously some rates are higher . This means that in ten years we must use more oil than has EVER been used in order to sustain growth. for more information watch this. http://www.youtube.com/watch?v=umFnrvcS6AQ

Nicole Foss

20 Jul 6:49am

Chris, growth is over, and the system is breaking down as a result. The bubble began to burst in 2008. the counter-trend rally has given way to the next phase of the contraction, which will be picking up momentum from here on. In a coupe of years, a lot more places are going to look like Greece, as financial contagion spreads. The UK is rapidly sliding into depression. Mortgages are already much harder to get as asset prices are beginning their slide. This will depress prices further in a spiral of positive feedback.

Since we are crashing the operating system, energy will be less of an issue for a while, as money will be the limiting factor. By way of analogy, if the operating system of your computer crashes, it will not work again until you reboot. Having a power supply for it is not enough to make it function.

Demand for energy will fall as growth becomes substantial contraction. It is in fact already falling in many regions (gasoline demand in the US, electricity demand in China etc). Energy prices will crash and energy investment will dry up as the cost of production will not fall as quickly, meaning that margins will be squeezed (to less than nothing for most). We’ve already seen this dynamic unfold in natural gas in North America. It buys us time in energy terms, since we do not burn through our inheritance so quickly, but it sets us up for a supply collapse later on, and when the economy tries to recover, it will hit a hard ceiling at a much lower level of energy availability.

The Peak Oil Poet

20 Jul 7:31am

i’d like to know why so many people are doomers

as far as i can see – and i have read far more than most – it’s a faith thing

you choose to commit to belief in a world view based on information that is, even considering how much has been written, scanty

some people thing “the end of the world as we know it” is obvious

but it’s not

peak oil etc are about awareness of potentials not commitment to belief

only a fool believes

even the commandments (first 3) are about belief and they say don’t commit to belief in anything

pop