14 Jun 2010

My Conference – Shaun Chamberlin on Stoneleigh’s peak oil/finance talk

So here I am. I fully intended to be giving the England match my full attention right now, but I’ve been left distinctly restive by this afternoon’s long session by Stoneleigh of The Automatic Earth, and feel the need to put some thoughts down.

Including the extensive Q&A session her talk lasted virtually three hours and covered a lot of ground, starting from a good runthrough of the ‘peak energy’ situation, but quickly focusing in on finance, as she believes that this is the factor that will most dramatically shape our immediate future. Notably, the talk attracted almost half the attendees of the Transition Conference, despite the numerous other Open Space sessions taking place at the same time.

For me her analysis helped to bridge the gap between comprehension and real understanding. I always feel that I don’t have a genuine opinion on something until I can listen to someone argue one point of view, then listen to someone argue the opposite, and truly understand what the root of their disagreement is, so that I can make up my own mind. With finance I have always felt unable to get to the root of the disagreement between those who forecast a cataclysm in the coming years, and those who argue that the system is far more resilient than some give it credit for.

That feeling has not been totally banished, but Stoneleigh (both today and in a bar-room chat until 2am last night) really helped me to close some big gaps.

She has agreed to email me her slides, but essentially her position is that we are just slipping over the edge into the greatest financial Depression the world has ever seen, off the back of the biggest financial bubble the world has ever seen. This will, of course, bring significant personal consequences for individuals, families and communities.

Consequently, her absolute #1 piece of advice to all and sundry is to get out of debt, as debts that may seem manageable now are unlikely to remain so as interest rates soar and property prices plummet (perhaps back to somewhere in the region of their 1970 values). Meanwhile, existing mortgage debts will stubbornly remain just as large, leaving many people in the ordeal of negative equity – their mortgage debt being bigger than the value of their house.

She also explained the ‘derivatives’ market in a usefully clear way. Whereas many of the world’s money-making schemes are based on cutting the proverbial cake into smaller and smaller slices, this system is based on giving more and more people rights over a single slice of cake. As this system unravels (as it surely must at some point, since not every claimant can have their cake to eat it), the bulk of the world’s money will essentially disappear, creating huge deflation. There will be less money in circulation relative to the amount of stuff, so the value of the money that people do have will actually go up, while earnings drop. As she pointed out, the key issue to be concerned with is ‘affordability’ not inflation, deflation, wages or anything else. How much useful stuff can you buy with what you have?

While not explicit about it as such, she seemed to be ranking the kinds of assets we might hold in terms of risk. In order, starting with the most desirable, that list was:

Useful assets – e.g. tools, land, a home that you want to live in, and that can supply what you need etc…

Cash – as deflation is likely to raise the value of cash, it’s a good thing to have, but cash in bank accounts is quite liable to evaporate. In response to the inevitable question of where we should keep cash, her repeated answer was “be creative”.

Gilts – Given that holding massive amounts of cash is both impractical and likely to arouse suspicion, she suggested gilts as the next least-risky place to put money.

Interestingly though, she believes that while useful productive assets are the most important thing (these are, after all, the source of our ability to support our communities and ourselves), she also pointed out that the price of such assets is likely to drop as the crisis tightens.

Accordingly, she counselled that one possible course of action for those unable to afford the productive assets they need (land, say) without going into debt, could be to minimise their exposure to the crash, preserve any cash that they can, and then buy more cheaply further down the slope. Those who can afford to buy outright now though, would be well-advised to do so, as while their assets, land etc. may decrease in value, this is of less significance if they plan to hold on to these assets long-term anyway, and in return they are buying themselves time to learn to use these ‘tools’, before they are relying on them.

As she spoke, the room was hushed and fiercely attentive, and you could see people absorbing the implications of what she said for their own financial plans, and those of their communities and families.

One very interesting question was from a Transitioner who is considering setting up a community-owned renewables project, based on taking out a loan to install PV, and paying back the loan on the basis of the Government’s feed-in tariffs. Stoneleigh argued that in the current situation, any Government guarantee to do anything over the next 20-25 years is barely worth the paper it’s written on, and so she would advise that such projects should be undertaken either without going into debt or not at all.

Above all, she stressed the urgency of the situation, and that we should not expect the financial situation to look at all like it does now in just a couple of years time.

In my one-to-one chat with her on Friday night, I asked her about my Student Loan, which is currently about the most benign loan imaginable, with a rate of interest generally lower than that available on tax-free savings accounts. She argued that I should pay it off as soon as possible nonetheless, even if that takes all the money I have, as savings in the bank are at a significant risk of disappearing, whereas loans never die. Indeed, they tend to be sold on down the line until you find yourself in debt to someone rather unpleasant.

We also talked about the best ways forward, given the difficult situation in which we find ourselves. We both believe that social ties are the most valuable asset we can possibly have, and that building these networks of trust is the most important work we can do.

She spoke of the example of the Great Depression of the 1930s, in which despite an abundance of food, fuel, resources and manpower, the whole system ground to a halt due to the unavailability of money to connect buyers and sellers. It reached the point where farmers were pouring away perfectly good milk while people starved up the road.

This put me in mind of Mark Boyle, the Moneyless Man, who I finally met for the first time at the Uncivilisation festival a couple of weeks ago. It strikes me that the simple idea of the gift economy – or Freeconomy – that he is practising, is exactly what was needed in that situation. If the farmers and the hungry had trusted each other, then without money, or indeed any other kind of transaction, a human can give another human food just for the love of it. And if the farmer needed help on his farm, then others might help for similar reasons. Perhaps if those needs coincide then barter might take place, but where they do not, the simple desire to help each other, and the trust that others will help out when you need something, could have got that society functioning again.

But as Stoneleigh pointed out, the key is building that trust ahead of time. In difficult times, your bonds with those you trust naturally becomes even tighter, as you rely on each other more, but your mistrust for those outside your circle can also increase, as you worry that perhaps they are just after what little you have.

Transition has always sought to widen and strengthen those circles, and that still looks like the most important work we can be doing, but Stoneleigh hopes to suggest a few tweaks to our tactics, as well as underscoring the sense of urgency.

A number of other Transitioners have already spoken to me about being rather shaken by Stoneleigh’s talk, but as she kept emphasising, we are doing the right work. Critical work.

(Edit – 03/10/10 Stoneleigh’s powerful talk is now available for purchase here.)

ps And England drew 1-1, but somehow that doesn’t seem like the most important thing I learnt today!

Shaun is a co-founder of Transition Town Kingston and the author of The Transition Timeline. He writes at www.darkoptimism.org

James Samuel

14 Jun 7:06pm

Thank you for this wonderfully detailed description of the talk and Nicole’s recommendations, which I will send to my friends.

I spent a long night listening to and taking notes from her fantastic talk, as soon as it was up online. I had a slightly different response and chose to look at the power of what we hold as a vision of the future. That, while we can project scenarios, we are still capable of co-creating an outcome that is not all bleak: http://www.jamessamuel.co.nz/nicole-stoneleigh-on-a-century-of-challenges/

Trugs

14 Jun 8:51pm

Those of us at the conference who did not attend the Stoneleigh talk, nevertheless felt its ripple effects. It probably shaped the tone and flavour of the whole event, reminding us (whether we went to the talk or not) just how serious is the situation we face and injecting a deep and hefty dose of “grown up” reality. This felt like a stepping up to responsibility moment – a step change in maturity for the movement.

There are many positive learnings to take from the Stoneleigh talk, the effect it had on conference participants and how it was handled. The way the conference team reacted was impressive – a lesson in dealing with unexpected consequences. Well done Sophy and well done the conference community for the supportive resilience that came through in so many individual and group conversations.

Why did facts and issues that we transitioners are mostly aware of have such a powerful effect? Does it show that some (most?) of us still have our moments of denial ? Well, if that’s the case, then this talk also showed that we can confront and deal with our fears, pulling from those fears an energy that is positive, practical, compassionate and effective.

In the conference closing circle Nick Sherwood expressed this particularly well and eloquently (I wish I could quote verbatim, but I didn’t take notes), drawing attention to the personal responsibility to remain informed on the issues and to build together community responses in the face of what we fear.

Excellent conference, made all the more meaningful by the effects of a talk that I didn’t even attend !

Rob

14 Jun 10:33pm

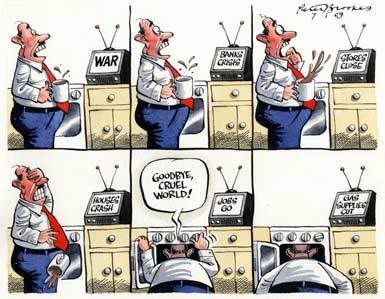

Great cartoon Shaun! Thanks for your guest blogging… much appreciated!

Gary Alexander

14 Jun 11:43pm

Great talk. I listened to the recording of it as I missed the conference. I am thinking hard about the consequences for me.

One general point of Shaun’s that I would like to echo, is the importance of learning to do as much as possible as favours, organised mutual support as this both strengthens community and avoids the problems of lack of money. And it is much easier than setting up a local currency!

JTM

14 Jun 11:46pm

The ads that Google places on the Automatic Earth blog make me smile:

‘Your Insurance a Worry? – 99% of People Could Save Money On Car Insurance. Quote Free Now!’

It’d be great to know if anyone reads her posts and thinks hmmm, best up my insurance…!

Dark Optimism » Blog Archive » My Conference – Shaun Chamberlin on Stoneleigh’s peak oil/finance talk

15 Jun 2:38am

[…] post was originally written for Rob Hopkins’ Transition Culture blog, but I have kindly given myself permission to reproduce it […]

Shaun Chamberlin

15 Jun 3:18am

Trugs, yes, I’ve been thinking too about why the talk was so powerful for so many.

I think perhaps because she wove the threads together so deftly – I’d heard almost all the parts before, but she helped us to step back and see the wood for the trees.

One other thing I’d like to mention here is the comment of one friend who I spoke to afterwards. He wondered whether perhaps Stoneleigh wasn’t questioning the resilience of certain existing structures enough – that perhaps as the crunch bites and people become more desperate, cornerstones of the economic system like property rights will cease to be respected.

Regardless of our financial standing, might we Transitioners then be organising to do things like directly putting land back in the hands of people who want/need to grow food on it, even if we can’t afford to own that land? It’s certainly happening elsewhere in the world..

Andy Wright

15 Jun 6:54am

Hi there,

If you can manage to defer paying your student loan until you are 50, it will automatically be cancelled. Here is the relevant clause:

“Cancellation

12.—(1) A borrower’s liability to make repayments in respect of all loans shall be cancelled if—

* (a) he dies; or

* (b) he is a person to whom paragraph (2) applies.

(2) This paragraph applies to a borrower who is not in breach of any obligation in relation to any loan and—

* (a) if he was aged less than forty when he last entered into an agreement for a loan, if he attains the age of fifty or if the loan for which he last entered into an agreement has been outstanding for not less than twenty-five years (whichever event is the sooner); or

* (b) if he was aged not less than forty when he last entered into an agreement for a loan, if he attains the age of sixty.”

http://www.opsi.gov.uk/si/si1993/Uksi_19931214_en_1.htm#tcon

Andrew Ramponi

15 Jun 11:38am

I agree with Stoneleigh, particularly on the value of social and natural capital and generally the avoidance of debt, but would be cautious on making rash emotional decisions on what to do otherwise with ones finances.

The predicament is that whilst we (here at Transition anyway) feel strongly about the coming “Long Descent/Emergency” over the years and decades ahead, no-one knows the answer to the what/when/how question.

Markets oscillate in their job of transferring and pricing risk, as buyers and sellers bet on the future. I would say that trying to call the absolute top or bottom of anything is virtually impossible, and definitely risky.

The inflation/deflation argument is too complex and there are intelligent and plausible arguments for what might come first. The financial markets “shoulder to shoulder” with governments, are so far, pretty resilient structures. It could be that we have a high inflationary period ahead, where prices rise and debt is eroded, followed by deflation, so short term gilts might be a very bad form of wealth protection. Being right too early could be just as disastrous as being wrong.

It could well be anyway that a global pandemic (apparently a high statistical probability) will radically alter the current urgency over the climate change/energy/financial paradigm.

In the end it’s often best to follow ones heart in major decisions; head in the clouds, feet on the ground.

Thomas

15 Jun 11:43am

Is that still going to be applicable in the future though, Andy?

tom

15 Jun 8:28pm

I wouldn’t be so quick to hand over the cash to the Student Loans Company. The UK is already a century into its collapse; we’ve already been through world wars, currency devaluations, mass unemployment, rationing, secession, ethnic conflict, nationalisation of vital industries, and later asset-stripping of those industries. Just because everything is fscked doesn’t mean this is a good time to panic ;o) I’d say our deficits in the balance of trade and governmental budget pretty much guarantee a sterling devaluation, even with a global depression. Or maybe not.

Meaningful design as a pathway to sustainability | Blue Sky Day

15 Jun 10:39pm

[…] when do you start? Does it pay to even think about it with economic predictions like this looming? I don’t think it can hurt. I plan to get out of debt and prepare my life for the […]

Il mondo che verrà: istruzioni per l’uso. « Io e la Transizione

16 Jun 1:55pm

[…] ogni caso questo post su Transition Culture è da leggere (è in inglese però), direi che è obbligatorio per chiunque stia ragionando sul […]

Shane Hughes

16 Jun 1:58pm

Shaun,

not sure i understood one thing. The idea is you have to get your money out of the banks and into cash or gilts – is that becuase they’re going to go bust? If so who will be chasing you for your mortgage repayments? How can one institutional system loose peoples money and not be able to pay its debts but then justify being hell bent on recovering debt?

thanks

shane

Gary Alexander

16 Jun 2:26pm

Nicole was saying that debts don’t go away because the holder goes bust, “they tend to be sold on down the line until you find yourself in debt to someone rather unpleasant” who will continue to chase you.

Shane Hughes

16 Jun 5:16pm

Hi Gary, hope you’re well. lets say i’ve got £20k savings and £100K mortgage in the same bank. i’d need more justification as to how the “selling down the line” would work ‘cos it would seem that if they have lost my £20K they have no moral right nor legal to sell on my debt. i’d say all bets (debts) are off!!

Josef Davies-Coates

17 Jun 3:51am

Shane,

As I understand it when a company goes bust all its assets (including debt owed TO them) get handed over to an administrator who is legally bound to do their best to collect the debts (to try and pay back as much of possible of what if owed BY them)

This work is usually done by big auditing firms like Deloitte.

The administration period lasts for a year (I think) but the debt can still be called in for another 7 years (I think).

But as Shaun mentions in a comment above, its quite conceivable that property rights will cease to be respected at some point.

Andrew Ramponi

17 Jun 9:40am

I don’t think focusing on low risk outcomes, such as the ending of basic property rights, is useful. If/when something like that happens, really all bets are off and, in any case, I certainly wouldn’t hold much faith in having at the ready a pre-planned blueprint response. There are just too many inherent variables.

The Transition vision to me is more about focusing on much higher probability challenges, like natural resource depletion and environmental destruction.

Though of course it can be good at times to think, chat and vent about anything! When might the next asteroid hit earth…?

Katy Duke

17 Jun 11:37am

Just listening….. fascinating & scary, but it would be good to see some of the slides too, are they available?

Jason

17 Jun 2:10pm

Yay for Stoneleigh, we love her. 🙂 I don’t understand why she doesn’t want her talk posted though, is it for financial reasons?

As for people talking about ‘moral and legal rights’ in respect of debt, I wouldn’t count on such nice ideas holding sway in the future with the force they do at present. Laws take money to enforce you know.

Having thought it through myself, I would say deflation is only likely right now — if someone starts trying to print their way out of debt, the swing could be to inflation instead.

Also, don’t forget to lists ‘skills’ amongst your assets. They can’t be lost and they are what will feed you. ‘Community’ too — and Stoneleigh is right, the sooner that trust is built the better.

riccardo

17 Jun 2:56pm

Dear Shaun, money and finance are just tools. I think that one should concentrate on the connection between fossil fuels consumption and industry. If Peak Oil hits large scale industry (the main premise of an EDAP), this will effect one way or another the financial arrangements that accompanied the growth of large scale industry and massive urbanisation.

It is not at all clear that US farmers were doing very well in the 1930s: they suffered from decreasing agricultural prices, increasing debts in real terms, and the “dust bowl”, a previous sign that we ignore the environment at our peril.

Caroline Walker

17 Jun 4:42pm

Does anyone have a view on the role of credit unions, if we are talking about personal decisions about where money should be? Run by local people, only lending out what they have in deposits, (100% reserve banking) to local people, distributing a dividend, not interest, they offer a localised alternative to mainstream financial arrangements for saving and borrowing, although obviously for paying bills and getting cash from machines you still have to use a bank.

We have just joined our local credit union and I would much rather any money I have spare is carefully and conscientiously lent out at reasonable interest by them to local people for whatever they need rather than sticking it in the bank to be played with on the money markets.

For a while in the 80s I helped to set up and run a women’s credit and savings group in India (Grameen Bank-inspired) and it worked really well, especially in preventing the women from becoming victims of loan sharks in times of trouble.

Along with local currency, surely local credit unions have a role to play in de-linking us from the mainstream? Would they be more resilient or less in the sort of times Stoneleigh so graphically describes?

Maxine Walker

18 Jun 1:03pm

What is a “gilt” – the only refewrence I have is in Websters dictionary, “a young female pig” ???

Jason

18 Jun 1:35pm

@Maxine Walker — ‘gilt-edged securities’, UK government bonds. Wikipedia has a good page.

Shaun Chamberlin

18 Jun 4:02pm

Shane, yes, as I understand it, historically debts never tend to die, whereas individuals’ savings/pensions definitely do.

It did occur to me a few years’ back that there is a possible alternative to the classic peak oil perspective of ‘get out of debt’, which is ‘borrow as much as you possibly can, use it to buy land and practical resources, and hope that the economic system collapses and you never get chased’. The more I’ve pondered that the less of a good idea it’s seemed though!

I can’t remember if Stoneleigh said it in the talk, but in person her explanation was that lenders (or their administrators) are more than happy to sell on debt they believe they can’t get debtors to repay. Those who are willing to buy your mortgage from them are thus those who think they have a better chance of getting the money out of you. As she put it, “Vinny the Kneecapper” can buy your mortgage at 5p on the pound, and if he only gets one in twenty people to pay up, by whatever means, he’s making money.

For myself anyway, I know I’m a happier person not relying on debt default if I can possibly help it.

@Jason, having spoken with Stoneleigh, I think it’s a mix of wanting people to hear/see the best quality presentation possible (they are working to produce a professionally recorded DVD of this talk as we speak), and the desire to see some small recompense for the hugely valuable work they have put into producing the materials.

Obviously she very much shares our sense of urgency but, like me, Nicole is doing her work with no salary, and we wouldn’t have this material at all without her, so I think we should respect her decision and buy the DVD as soon as it is available to show our appreciation of her work, and to spread the message.

Shaun Chamberlin

18 Jun 4:22pm

@Andy Wright & tom: Thanks for the advice on the Student Loan, especially as I’ve had a couple of emails from others pondering the same question. I definitely have some more thinking to do on this one.

I am in the (fortunate?) position of not earning enough to have to make payments on my Student Loan as yet, so yes, under current rules, waiting out a couple of decades for it to be cancelled seems to make perfect sense.

Actually, since I took out my loan when I was 18, those paras you copied seem to say that my loan should be cancelled when I am 43 (when “the loan for which he last entered into an agreement has been outstanding for not less than twenty-five years”)

Which would make my decision an easy one if not for the fact that the next couple of decades aren’t likely to look much like the last twenty. As Stoneleigh said in our bar chat, in times of Depression, history shows that governments don’t play fair, and laws are very liable to change.

The worst case scenario would be to lose any savings and then find that our Student Loans are suddenly made a lot less benign, and we are being chased for them…

So is it better to cancel out debt with savings, on the basis that debt is more likely to survive than savings, or to keep cash on the basis that this will be extremely valuable, and that this particular debt is currently both benign and temporary?

For now I think I’ll be keeping my loan, doing some more research, and keeping a close eye out for any changes in the situation.

@Caroline Walker – personally I think that Credit Unions are wonderful things, and should be used and supported wherever possible. But I’m told that they currently tend to keep their money with the big banks, so they’re vulnerable too. Not really my department, but I had a chat with a guy a month or so back who is working to set up an alternative system whereby credit unions would have their own independent savings, which seems important work.

Jason

18 Jun 4:31pm

@Shaun, yes that’s what I thought.

I think we should respect her decision and buy the DVD as soon as it is available to show our appreciation of her work, and to spread the message.

I agree and have also donated to the Automatic Earth website, which I have followed for about a year now.

Skintnick

18 Jun 6:22pm

I’m big on the idea of Credit Unions. It seems to me that there are people who have their life savings invested conventially and there is really no safe haven for that any more, long-term. I think transitioners should be encouraging these cash-rich members of the community to transfer investments into an institution such as a credit union which will provide capital for investing in the local economy where it can be targetted towards the jobs and businesses suited to that particular community. If the structures are put in place properly and the whole community gets behind such a scheme I see no reason why those investors shouldn’t get better returns than in the city of London, and the benefits to the local economy are for everyone.

Skintnick

18 Jun 8:22pm

If I had one criticism of Stoneleigh’s talk (which I got on audio, not present for what was obviously a sobering experience) it is that the target audience appeared to be those with savings to protect, whereas in my experience of transition the majority is just trying to get by and think about hand-to-mouth in the future!

Shaun Chamberlin

19 Jun 12:22am

Student loan update: The info that Andy Wright posted above applies only to student loans taken out in 1997 or earlier. Student loans from 1998-2005 (like mine) are only cancelled at age 65 🙁

More clearly presented info on this here: http://is.gd/cUJdN (although they aren’t as worried about the future of the financial system as many of us are)

James Samuel

19 Jun 11:20pm

I am passing on this note that my friend Will posted over on my blog, in response to Stoneleigh’s talk.

—

Hey James, thank you for providing that download… well Nicole Foss has quite a lot to say in that 70 mins.

Lots of fast paced hard hitting info… I don’t know how to explain it, her talk didn’t ring fully true to me… It was like she was brushing over things that I’ve been thinking about a lot, both financial and in the energy sector, and she didn’t introduce any of the sense of uncertainty of how it will play out, when in fact much is in debate, even by the out-of-the-box thinkers who do this stuff day and night.

I just finished up a bit of reading this morn… and it reminded me of one analysis a year ago in the midst of the credit crisis. It was that the credit crisis would lead to a currency crisis as governments absorb debt as the lender of last resort (as has happened all this year). As governments continue to print money, and absorb debt, confidence will drop out of their respective currencies, so we can expect currency collapse. People will turn away from government printed money and go for hard forms of money (real things).

Under the currency collapse scenarios, her recommendations (on deflation) are quite wrong (selling your house, sit on cash).

BTW… The energy thing has been percolating in my mind since your last email so did some more research.

As it turns out only around 6TW of worldwide energy consumption is from oil (1 cubic mile = 55TW), so she’s overstated the energy problem by an order of magnitude. And roughly 75% of our energy is industrial/commercial/transport related so it goes to reason that these will be greatly tempered over the coming economic times. Will it extend our runway for renewables? Will we spend it wisely?

I ran some more numbers, just on the solar PV alone (because it’s my pet interest)… A bit like Moore’s law, PV production doubles every 2 years. If we have 10 years of an “oil runway” by 2020 we get 0.7TW of solar capacity… BUT what if we have 20 years?. I works out we’ll have 23TW (then divide by 3.5 because the sun doesn’t always shine).

(We currently use around 16-17TW, the sun supplies us with 89,000TW if we could harvest it all.)

I thought I’d leave on a sunny note 🙂

News from Shaftesbury TT « Transition Town Sturminster Newton

20 Jun 11:47am

[…] is becoming the third driver alongside climate change and peak oil. See this fascinating blog: https://www.transitionculture.org/2010/06/14/my-conference-shaun-chamberlin-on-stoneleighs-peak-oilfinanc… Our Aim To make Sturminster Newton as self-sufficient and resilient as possible and to raise […]

Shaun Chamberlin

22 Jun 5:52pm

Highly recommended watching – an 8 minute video reacting to Stoneleigh’s talk, with Rob and Pete of the Transition Network: http://is.gd/cZkKu

toni

23 Jun 11:46am

This is probably a really silly question but where do the credit unions store the money? Are they really a safer place to save money?

I am wondering if we might be better off persuading a local farmer or land rich people to take our money (as if I had any!! ;-)) to pay off any mortgage and therefore enable them to grow food without stress and therefore continue to feed us in the longer term? Co-ops sort of thing?

Andy Wright

23 Jun 11:53am

Toni,

I think you’re talking about a convertible community http://www.appropedia.org/Convertible_community

I heard about this from the US recently. The farmer takes a month subscription off some city folks, say £10 a month off 100 people. He uses this 1000 quid to pay off mortgage, buy more land, build resources, grow vegetables. Then in the event of any sort of collapse, these people can go and live on the farm!!

Skintnick

23 Jun 11:41pm

Isn’t the point that a credit union doesn’t store money in the sense of depositing in any of the conventional capitalist paraphenalia, but ‘stores’ it by investing in the community – loaning out to local businesses and individuals in a way that cuts profiteering out of the equation?

Stoneleigh a Milano e Carimate « Io e la Transizione

12 Jul 2:20pm

[…] ha scosso gli animi della recente Transition Conference disegnando con lucida chiarezza gli scenari energetico economici dei prossimi anni (ne avevo […]

Valerie

15 Jul 1:26am

That was my understanding of credit unions. They are governed differently according to country and province.

Reports on 2010 Transition Network Meeting | Resilience Science

19 Jul 8:56am

[…] built her argument was very compelling. You can read Shaun Chamberlin’s reflections on her talk here, along with some insightful comments from other […]

Betterworld Now

20 Jul 1:14pm

Credit Unions in Ireland operate on a 50% asset to lending ratio, they hold half the value of loans in liquid assets. However, those assets are typically invested in other financial institutions like pensions, bank deposits, gilts etc.

At some point in the collapse, it will become necessary to nationalise all unproductive land and distribute it to those willing to produce food for local consumption (this is already happening in Venezuela and Brazil – and some other countries). Buying land is not itself a form of security – it is necessary to produce food on that land for it to be socially useful.

As an interim measure, trasnitionsists should push governments for a general legal permission to occupy derelict land and produce food on it in a sustainable way. Notices could be posted advising landlords that unless the land is brought into production within, say, 6 months then it will be legally occupied and planted with food crops. Repossession of occupied land would then be granted only after harvest of those crops. Voluntary release of occupied lands after 3-5 years of crop rotation could be written into the generalised legal permission to prevent the establishment of squatter rights under civil law and encourage proper soil stewardship.

We in Ireland have huge land resources around our cities which are now under public ownership as part of the NAMA process. These lands will not be developed and will form very useful green belt areas ideally located for local food production.

Government will need to be forced to grant generalised licences initially by high-profile illegal occupations, as happened in Brazil and Venezuela.

Open access to land for food ~ James Samuel

23 Jul 10:59am

[…] This was from a comment on the post "My Conference – Shaun Chamberlin on Stoneleigh's peak oil/finance talk". Author: Betterworld […]

Future Proof Kilkenny » Blog Archive » Stoneleigh Lecture

16 Aug 9:37am

[…] of Europe which included a slot at the recent Transition Network conference. By all accounts her presentation added a huge sense of purpose and urgency to the work of transition town groups and has been the […]

It’s a Rich Man’s World | Transition South Lantau

10 Nov 4:35pm

[…] The one thing that seems to be the bottom line for all of them is – get out of debt. If the economy bombs and people are losing their jobs and they can’t repay their mortgages and they’ve got a string of debts created by their profligate use of credit cards, and there is no sign of an economic recovery – that requires copious amounts of cheap oil, which we’ve no longer got – then there are going to be a lot of people suffering. I don’t want to be one of them. I’ve long been thinking about getting rid of my debts – in my case that ‘simply’ means my mortgage – but the person who really tipped the scales for me was Nicole Foss, alias Stoneleigh of the Automatic Earth at http://theautomaticearth.blogspot.com She first came to my attention a year or so ago, but just lately she has been touring North America and Europe giving talks on the economy, and she’s been getting a lot of attention. She gave a talk at the Transition Annual Conference which stunned people (a bit odd that, I thought, as transitioners are supposed to be aware of these things, aren’t they?) and which was reported on by Shaun Chamberlin: https://www.transitionculture.org/2010/06/14/my-conference-shaun-chamberlin-on-stoneleighs-peak-oilfinanc… […]