9 Sep 2009

Coming Soon: The Brixton Pound!

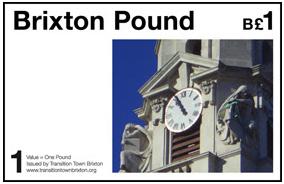

Not long to go now before the launch of the Brixton Pound. This is the first time, to the best of my knowledge, that an urban district has launched its own currency. It is a bold experiment, and like all the best bold experiments, it starts with a party; September 17th, 7.30pm, Lambeth Town Hall. There is expected to be huge demand for this historic event, so you need to book in advance. Personally speaking, I wouldn’t miss it for the world! I’ll be speaking at the launch, along with David Boyle of nef, and Derrick Anderson (Chief Executive of Lambeth Council). As a taster, here is an excellent article about the Brixton Pound by Josh Ryan-Collins, from the latest edition of Fourth World Review.

Not long to go now before the launch of the Brixton Pound. This is the first time, to the best of my knowledge, that an urban district has launched its own currency. It is a bold experiment, and like all the best bold experiments, it starts with a party; September 17th, 7.30pm, Lambeth Town Hall. There is expected to be huge demand for this historic event, so you need to book in advance. Personally speaking, I wouldn’t miss it for the world! I’ll be speaking at the launch, along with David Boyle of nef, and Derrick Anderson (Chief Executive of Lambeth Council). As a taster, here is an excellent article about the Brixton Pound by Josh Ryan-Collins, from the latest edition of Fourth World Review.

Keeping it in the neighbourhood: as the recession reveals the vulnerability of our monopolistic retail sector, communities across the UK and United States are turning to complementary currencies to support local economies

By Josh Ryan-Collins

“If ever there is an image that symbolises the times we are in, it is desolate town centres with rows of empty shops where once there were small local retailers, a Woolworths or a Zavvi. Decisive action must be taken to stop our high streets turning from clone towns into ghost towns.”

Margaret Eaton, Chief Executive, Local Government Association, February 2009

The UK recession is finally waking up politicians to the vulnerability of our current retail model to economic shocks. Since September 2008, there has been almost 2000 multiple retailer store closures across the UK, with many more going in to administration and over 40,000 jobs lost.High streets lined with homogeneous chain stores have suddenly found themselves emptying out, as the easy credit-driven consumer binge of the last decade came to a dramatic end.

Whilst the media have focused on the thousands of job cuts being made by the chains and big corporations, it is small businesses that account for the majority of private sector jobs: 59.2% in 2007, around 13.5 million jobs overall. In fact, between 2000 and 2006, the UK has experienced a decrease in workforce amongst the nation’s largest businesses from 44.9 to 41.1 percent, while the nation’s smallest businesses have grown from 13.5 to 15.9 percent of the private sector workforce. Sadly, our deregulated banking system, the cause of the credit crunch in the first place, is in no shape to help small businesses already facing vicious competition from supermarkets and extortionate ‘upward only’ rental agreements from often absentee landlords. As the Federation of Small Businesses suggest, our local shops and services are facing extinction:

* 42% of our small towns and villages no longer have a shop of any kind

* 2000 local shops are closing each year

* Since 1990 40% of bank branches in the UK have closed, with 2,737 bank

* branches closing in the last ten years, according to the Campaign for Community Banking

* 3000 Post Offices face closure across the UK

* Up to 1000 small stores could close on the back of the Post Office’s cull of 2,500 of its offices

* 39 pubs are closing each week because of the combination of low supermarket prices and high taxes with recent failures have taken place in urban or semi-urban areas, in some cases across the road or next to a closing post office.

Yet the case for keeping small retailers and businesses in our local communities is overwhelming. Studies in the UK and the United States show that smaller, independent local shops spend more of every pound spent on their premises in the local community. Of course there is no universal ratio as every shop is different, but in a study of the major retailers in 2002, nef (the new economics foundation) showed that on average supermarkets and other large chains spend just 10-12 pence in every pound in the local community. The rest ‘leaks out’ to shareholders in the city, to suppliers from all over the world, to national HR and distribution, building, legal, security, and other support service contracts and distribution systems.

In contrast, small independent shops are more likely to employ local firms for these kind of services and spend any profits locally. A study of the West Michigan Economy in the U.S. concluded that if residents of the area were to redirect 10 percent of their total spending from chains to locally owned businesses, the result would be $140 million in new economic activity for the region, including 1,600 new jobs and $53 million in additional payroll. A similar study in San Francisco, calculated if residents were to redirect just 10 percent of their spending from chains to local businesses, that would generate $192 million in additional economic activity in San Francisco and almost 1,300 new jobs.

In response to the collapse of local economies and a realization that local shops are vital to economic wellbeing (not to mention their positive effects on social networks and the environment), communities in both the UK and US are taking a radical approach – they are creating local complementary currencies that can only be used in local independent shops. There are, according to some estimates, around 75 complementary currencies circulating in the US, including the recently initiated ‘Plenty’ in North Carolina, the ‘Bay Back’ in Traverse City, Michigan and in Detroit, where unemployment stands at 22%, the ‘Detroit Cheers’.

The most successful of these ‘hard’ or ‘paper’ currency models lies in the rural region of Berkshire in Massachusetts in the United States. ‘Berkshares’ trade at a 5% discount to the dollar so you can trade in U.S.$95 will and get 100 Berkshares to spend in local shops. If businesses swap their Berkshares back in to US$, they lose the discount, encouraging circulation.

From its inception in 2006, Berkshares has been steadily growing, and now has more than 350 local businesses that accept BerkShares and over two million BerkShares have been circulated. The program has received almost non-stop press coverage since the recession began in the US and is increasingly being seen as a model for a stable, localized, value-added economy.

In the UK, the pioneers have been communities in the Transition Network. Totnes in Devon and Lewes in East Sussex have developed Totnes and Lewes ‘Pounds’ which trade one to one with sterling and can only be used in local independent stores. Both schemes have received massive media attention and initiated a wave of interest amongst other Transition communities across the UK. The Brixton Pound, the first to be set in an urban area, is due for launch in September 2009.

In Lewes, the currency was set up primarily to support small businesses in the face of encroaching supermarkets, high rents and draconian parking laws, but also, in line with local residents concern with climate change and peak oil, to help shorten supply chains. 30,000 Lewes Pounds have been issued since the Lewes Pound was launched in September 2008 (the entire initial print run of 10,000 Lewes Pounds sold out at a launch that was reported on by Japanese TV) and 150 traders have signed up to use the currency, from Harvey’s Brewery and Terry’s Fishmongers to Rik’s disks and a local acupuncturist. A number of stores are using the Lewes Pound as a way of boosting their marketing by offering discounts and deals for payment of goods in Lewes Pounds. Other traders are paying their own suppliers and staff in Lewes Pounds, who in turn spend them with other Lewes businesses, thus creating a virtuous circle that benefits the town. Oliver van Heel, one of the team that created the Lewes Pound, says:

“We wanted to give the Lewes community a reason to seek out and choose local traders. We didn’t expect to have a huge economic impact from the outset, but we have succeeded in raising awareness and starting a conversation within Lewes about the impact residents can have in stimulating the local economy.”

Susan Witt, who helped found Berkshares and works for the EF Schumacher Society which helps manage the currency, considers its social value to be just as important to its economic impact. She describes Berkshares as ‘slow money’, which helps build social networks through the everyday interactions between local consumers and local producers that globalisation threatens to undermine. As the heterodox economist Jane Jacobs has eloquently put it, these are the ‘the sidewalk contacts that are the small change from which a cities’ wealth of public life may grow’.

Nevertheless, the economic impact of the Totnes and Lewes pounds remains small in comparison with Berkshares and the next step is to find ways to support and upscale these currencies. One major barrier in the expansion of local complementary currencies in the UK is the lack of any kind of genuine local banking infrastructure. Berkshares has the advantage of still having local banks with an interest in supporting local businesses. Berkshares are accepted and issued by 4 regional banks with a total of 12 branches across the region.

In contrast, Banks in the UK, through successive rounds of deregulation and mergers and the opening up of global financial markets, gradually lost all interest in local businesses as a means of making money. They weren’t, in fact, doing much of a job even before the credit crunch, making their money not through careful loans to local businesses they knew and understood but through investment in the speculative markets of high finance and consumer loans.

But there are sign that community banking is making a come back. Essex County Council and the City of Birmingham local authorities’ are creating local banks. Their aim will be to lend public money at reasonable rates to cash strapped small businesses and homeowners in their areas. Birmingham City council, the UK’s largest local authority, is planning to create a bank to lend up to £200m to small businesses. The Bank of Birmingham (AKA BoB), which had its first incarnation in 1916 when Neville Chamberlain was the Mayor of Birmingham, will apparently also take retail deposits.

Meanwhile, in March a coalition of trade unions, business organizations, pensioner groups and think tanks launched a comprehensive proposal for a new ‘Post Bank’ to run as part of the Post Office Network. The Postbank would serve the local community and businesses and be a secure place for savings. In other parts of the UK, Community Banking Partnerships are being piloted, creating shared administrative and back office functions for organizations providing ethical credit, debt and financial advice and help with home energy. More generally, there are signs of a reemergence of the cooperative financial sector as a genuine alternative to mainstream banking, with both the Cooperative and Nationwide banks, still genuine building societies, attracting more and more members.

Transition Brixton is working closely with Lambeth Council in developing a Brixton Pound, due for launch in September 2009. The Council really sees the benefit of the B£ in term of supporting local businesses and is promoting the B£ to all of its 2500 staff members and the currency will be accepted in the staff cantines. Its hoped that in the future it might be possible for the Council to accept the B£ as part-payment for council and other local taxes or payments or to part-pay council staff.

Ultimately, the organizers of these currencies are keen to ‘de-couple’ from national currencies and research is needed in to what alternative ‘backing’ might be effective in terms hardwiring our money system in to the limits of the natural resources around us. A basket of locally produced goods, kilowatt hours and time are all possibilities. What is clear is that current centralized currency system, based much like the banks and our supermarkets on a defunct notion of efficiency which sees bigger as always better, is failing us. In a globalised economy where economic and energy shocks are carried around the world at enormous speed, the need is institutions, including currencies, that are small enough to fail without bringing the house down.

And we also need a money system that will incentivise us to produce more locally and trade more locally for when peak oil arrives there is every chance that our fossil fuel driven retail and food system will collapse fairly rapidly – the current recession has already revealed its vulnerability. More research is needed to better understand the potential of complementary currencies and what optimal currency zones might look like in order to create a more sustainable and resilient monetary system. But government and local authorities, and most of all communities, should encourage experiments in complementary currency systems that will only become more important in the transition to a low-carbon economy.

About the author

Josh Ryan-Collins is a researcher for nef (the new economics foundation), one of the UK’s leading think tanks promoting ecological sustainability, well being and social justice. Josh is also a founder member of the Brixton Pound.

www.neweconomics.org

www.brixtonpound.org

Coming Soon: The Brixton Pound! » Transition Culture | The Credit Crunch Blog

9 Sep 2:53pm

[…] Coming Soon: The Brixton Pound! » Transition Culture Posted by on 9 September, 2009 No comments yet This item was filled under [ Uncategorized ] […]

Tweets that mention Coming Soon: The Brixton Pound! » Transition Culture -- Topsy.com

9 Sep 3:33pm

[…] This post was mentioned on Twitter by Chris Byrne, GreenFeed and Kit R. Chris Byrne said: Maybe, but not the last! RT @donmacca: The Brixton Pound – 1st Urban #altcurrency? http://bit.ly/elofT via @kaskadia #neweconomy […]

Coming Soon: The Brixton Pound! » Transition Culture | Alternative Loans

9 Sep 6:02pm

[…] more from the original source: Coming Soon: The Brixton Pound! » Transition Culture Share and […]